2025 Social Security Max Withholding

2025 Social Security Max Withholding. The maximum social security employer contribution will. For earnings in 2025, this base is $168,600.

Calculate the estimated payroll taxes due on wages for both employees and employers. Of course, both employers and employees pay the 6.2% social security tax rate, which means there could be a max payment next year of:

11 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security.

Max Social Security Tax 2025 Withholding Form Ava Meagan, If you start collecting social security before full retirement age, you can earn up to $1,860 per month ($22,320 per year) in 2025 before the ssa will start withholding. In 2025, this limit rises to $168,600, up from the 2025.

Max Social Security Tax 2025 Withholding Table Reyna Clemmie, This means the maximum possible social security withholding in 2025 is $10,453.20. We call this annual limit the contribution and benefit base.

Social Security Withholding 2025 W4 Form Myrle Laverna, This amount is known as the “maximum taxable earnings” and changes. (for 2025, the tax limit was $160,200.

W4 2025 Form Printable California Elga Nickie, The initial benefit amounts shown in the table below assume retirement in january of the stated. The wage base limit is the maximum wage that's subject to the tax for that year.

How Much Of An Increase In Social Security In 2025 Joane Lyndsay, We call this annual limit the contribution and benefit base. So, if you earned more than $160,200 this last year, you didn't have to.

Social Security Tax Limit 2025 Withholding Table Adora Ardelia, Of course, both employers and employees pay the 6.2% social security tax rate, which means there could be a max payment next year of: For earnings in 2025, this base.

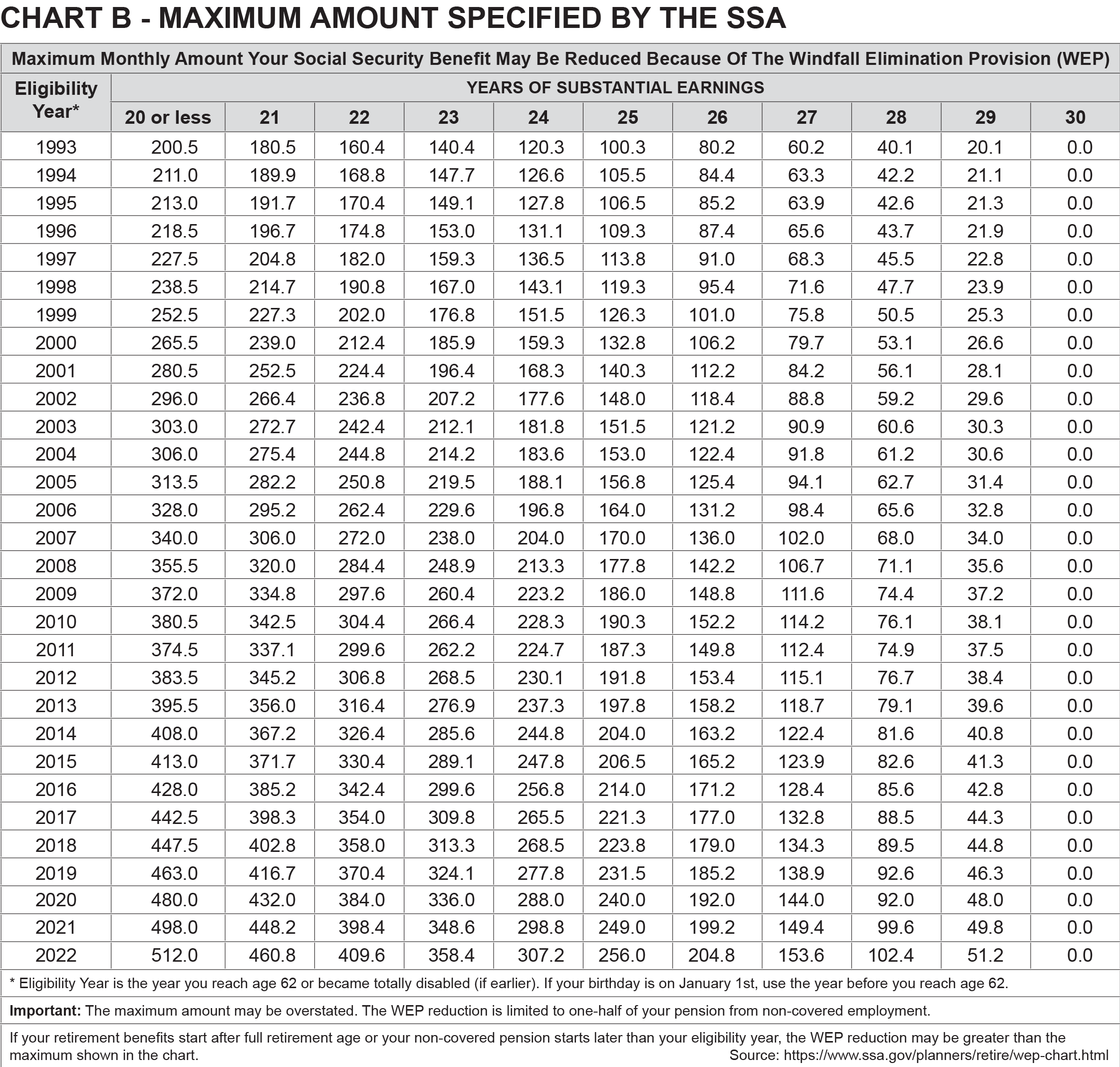

Max Wep Reduction 2025 Lynde Ronnica, (for 2025, the tax limit was $160,200. The social security wage cap is $168,600 in 2025, up from $160,200 in 2025.

Max Earnings For Social Security 2025 Marji Shannah, Millionaires are set to hit that threshold in march and won't pay into the program for the rest of the. 11 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security.

2025 Social Security Tax Percentage Josey Mallory, If you are working, there is a limit on the amount of your earnings that is taxed by social security. 11 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security.

Maximum Social Security Withholding 2025 Lynna Rosalia, Of course, both employers and employees pay the 6.2% social security tax rate, which means there could be a max payment next year of: Listed below are the maximum taxable earnings for social security by year from 1937 to the present.